For instance, if you are located liable in an automobile mishap that led to damages to your automobile over $2000, you can anticipate increases read more in your auto insurance policy to last for 3-5 years. That is a really specific instance. The extent of the mishap and also infractions significantly impacts the length of time your insurance will be greater.

How Can I Get a Cheaper Vehicle Insurance After a Car Mishap? If you create a mishap there is little you can do to prevent greater automobile insurance coverage prices.

In the short-term to obtain less costly car insurance coverage after an automobile accident, you need to check out different providers. Each provider takes care of motorists differently. You will certainly still be taking a look at an increase to your insurance after the mishap. However, you might be able to discover a provider that will enhance your rate less than your existing carrier. cars.

Ask for Mishap Mercy This is something that requires to be done when going shopping for insurance. Prior to getting in a mishap, look for an insurance firm that has crash mercy.

In situations that you look for as well as are approved accident mercy, your auto insurance policy prices won't go up. Participate In Web traffic College Many insurance companies will certainly lower prices for drivers that have a background of automobile crashes if they participate in traffic institution.

Do Not Submit Claims for Small Things The more usually you make claims, the much more your insurance coverage company needs to make payments - insurance. Hence it is important you just submit cases for severe damages to home or for mishaps that require aid. If you submitted a claim lately in an at-fault auto mishap, delay declaring additional insurance claims for as lengthy as you can.

Some Known Incorrect Statements About 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

vans cars automobile accident

vans cars automobile accident

Your auto insurance firm assesses their customers' premiums on the threat they present to the firm financially. The even more cash they need to pay, the greater risk you are to them monetarily. 3. Rise Your Credit rating In general, individuals with credit history that are greater than 600 experience better premium offers.

This might spend some time, however it will pay off over time. 4. Consider Your Insurance deductible There is an inverted partnership in between your insurance deductibles and also your insurance coverage costs. By choosing a reduced deductible you will certainly have a higher premium. Having a greater deductible will certainly result in a lower costs.

prices cheap insurance cheapest car insurance perks

prices cheap insurance cheapest car insurance perks

Do Auto Insurance Rates Boost In A Different Way Based on Age? In Maryland, auto insurance policy expenses differ based on the vehicle driver's age.

Leaving your insurance coverage company with no expenses associated with the accident. Inevitably your auto insurance provides thinks about how costly it is to guarantee you. If you are at mistake for a mishap that makes you a higher danger. However, if you have actually remained in serval accidents that are not to blame your danger degree still boosts.

No matter of who is at fault. Will a No-Fault Automobile Accident Show Up on My Document? No-fault cars and truck mishaps do turn up on your driving document. You might have a tidy record as well as think about an excellent chauffeur (affordable car insurance). When you file a claim and an insurance supplier gives you cash that will result in the mishap being area on your driving document.

When a chauffeur that goes to at-fault does not have insurance coverage then your insurer becomes responsible to pay for injuries as well as problems to your automobile. Although it was not your fault the accident is much costlier for your insurer when the at-fault vehicle driver is uninsured. Therefore, elevating your vehicle insurance policy costs. cheap insurance.

The Only Guide for How A Not-at-fault Claim Can Raise Your Insurance Costs

It is important for you to stay clear of connecting with them whenever feasible to stay clear of being labeled a high-risk chauffeur by them. The Conclusion on Automobile Insurance Coverage Fees as well as Accidents It is constantly a better scenario when you are not responsible for a crash - auto insurance. Your insurance policy may still rise, however not almost as much.

If you have actually remained in an accident and require legal assistance, please get in touch with ENLawyers (cheap car insurance).

Most of us will certainly call our insurance policy representatives if we're involved in a significant mishap and the damages are determined in the tens of thousands of dollars - credit."Insurance providers use programs like crash mercy as well as vanishing deductibles not only to attract new consumers and also incentive lengthy term ones, but to make you assume twice prior to submitting a claim."If there weren't effects for submitting a $200 insurance claim, you 'd see plenty much more $200 claims being filed," says Elder Consumer Analyst Dime Gusner.

Also without mishap forgiveness, some auto insurance policy carriers may forgo surcharges for your first accident and also those with minor problems. IN THIS ARTICLETo insurance claim or otherwise to case, It almost goes without saying, yet if you remained in a minor crash and the insurance claim amount is barely over your deductible, pay of pocket - car.

50 rise. Do insurance costs go up after a crash claim? Submitting a claim for an at-fault accident implies you're a greater risk to the company as well as are costing them money.

Your costs can increase in three various ways: You can pay a mishap surcharge, your base prices can climb, or you could lose the price cuts that cut your expense."An insurance coverage company with the least expensive price might have the most expensive charge, in the kind of surcharges, for accidents," Gusner notes.

The Greatest Guide To Filing An Auto Damage Claim With Another Insurer - Nj.gov

Also so, you might see a boost in your base rates due to the fact that you have actually been relocated to a riskier rate of chauffeurs."In lots of states, insurers placed motorists into pails as well as base their rates on the team as a whole," states Gusner.

Freedom Mutual uses mishap mercy totally free to certifying consumers, says agent Glenn Greenberg. "Mishap forgiveness suggests the cost will not go up as a result of a client's first crash if their driving record is accident-free and violation-free for 5 years-- whether they have actually been with Liberty Mutual or a prior insurance coverage carrier," Greenberg states.

Allstate provides accident mercy as an "add-on" to your car insurance plan. Thus, to have the coverage, you'll pay a higher premium. Mercy does not imply the mishap never ever took place. The occurrence still appears on your claims report. As well as mishap forgiveness isn't mobile: If you choose to change insurance companies, the accident will certainly be made use of when computing your premium with the brand-new company.

insurance companies low cost auto insured car low cost

insurance companies low cost auto insured car low cost

Think two times before you submit, Leaving a little money on the table to maintain low future prices isn't a deluxe every person can manage."Car insurance coverage is implied to aid avert financial disaster," states Insurance coverage.

The same holds true if the various other driver's coverage isn't enough to pay for your damages, requiring you to resort to your underinsured driver coverage. Submitting a Claim When Not to blame for a Crash Colorado is an at-fault state, which means the insurance firm of the irresponsible chauffeur spends for damages.

perks cheaper car affordable auto insurance

perks cheaper car affordable auto insurance

A left turn accident is almost constantly the mistake of the individual that made the turn. One more instance is with a rear-end mishap, which is typically the fault of the person who struck the back of the lorry.

How Much Does Insurance Go Up After An ... - Car And Driver for Dummies

It is typical for automobile insurance policy to increase after being associated with a cars and truck mishap in Maryland. If you are an at-fault vehicle driver in the accident, your cars and truck insurance policy will more than likely increase after suing. In Maryland, automobile insurance policy prices increase significantly relying on the severity of the accident, driving record, and also the type of cars and truck insurance policy you have.

trucks trucks insurance companies vans

trucks trucks insurance companies vans

Auto insurance coverage rates differ from one state to another after an automobile accident and some states report more expensive prices than others. Maryland is taken into consideration to be a state with one the most affordable premium boosts after a car accident. the ordinary vehicle insurance policy costs rise in Maryland after an at-fault vehicle crash is $1,900, compared to the typical rise in the USA of $2,010. cheapest car.

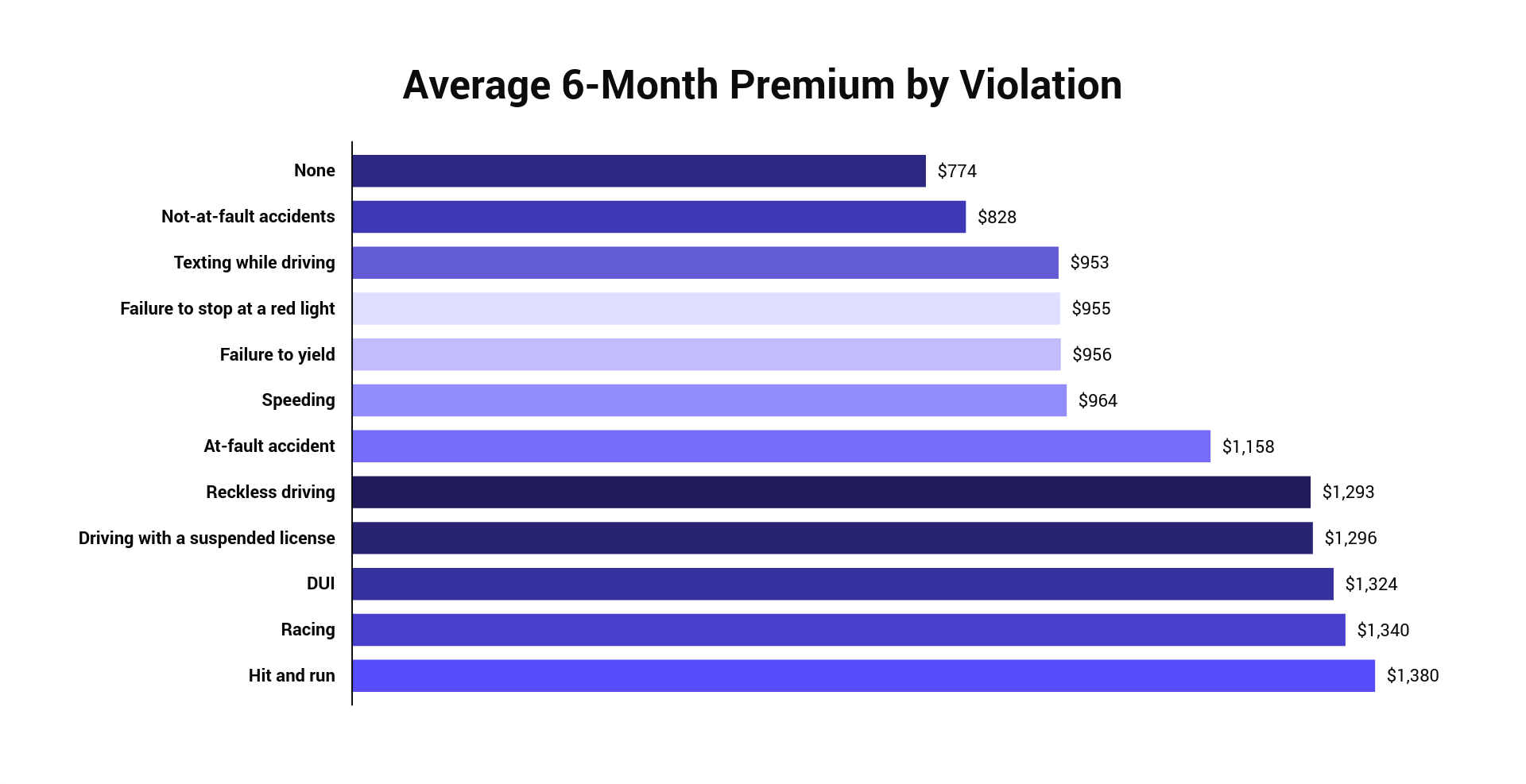

5%. Exactly How Much Does Cars And Truck Insurance Policy Increase Depending Upon the Offense? Your automobile insurance policy will likely rise if you are to condemn in a vehicle accident or are convicted of an on-road infraction in Maryland. the much more offenses you obtain, the greater rise in the price of your car insurance.

Violations that relate to Drunk drivings or Duis will trigger one's auto insurance to rise to regarding $490 annually. Why Do Car Insurance Coverage Rates Go Up After a Crash? Several drivers who have been at mistake in a car accident often tend to ultimately cause one more accident. Insurer experience an additional risk as well as higher expenses when insuring a new or at-fault motorist compared to a driver with a tidy document.

How Much Time Will Your Price be Greater? An at-fault crash that left damages to your lorry that go beyond $2,000 can create car insurance policy costs to last anywhere in between 3 to five years. The size of time in which one's automobile insurance continues to be high depends upon the state or insurance provider - cheaper auto insurance.

The severity and kind of accident that happens can figure out the size of time that one will experience a rise in rates. Typically, for no-fault crashes, one may experience three years of increased rates. For a minor accident, is it usual for insurance to be elevated for about 5 years.

8 Easy Facts About Why Did My Auto Insurance Rates Change? Explained

Every one of these rates differ amongst companies, yet it is vital to remember the ordinary time in which you will certainly be spending for violations. Just How Can You Get Cheaper Insurance After an Automobile Mishap? If you are responsible for an automobile crash, you will likely experience greater vehicle insurance prices, however you will certainly not be stuck with the rates forever (accident).

Your first step would certainly be to compare vehicle insurance prices estimate from various business as well as pick the supplier that finest fits your needs. risks. Exactly how can I reduce my prices after a crash? You can't transform the mishap after it occurred, there are a few points you can attempt to minimize your costs.

When shopping for automobile insurance policy, ask the insurance firm if they have a mishap mercy practice (perks). Business that use mishap mercy after one at-fault automobile mishap will permit you to receive no boost in premium if you fit particular criteria. If you are to blame for an automobile crash and also seek mishap mercy as well as it is granted, your automobile insurance policy prices will certainly not raise.

You will require to take an accepted protective driving course to fulfill the requirement. Stay Clear Of Declaring Insurance Claims for Small Points: The more cases one makes, the more payouts an insurance provider experiences. With this being said, it is essential that you just submit cases for considerable building problems or mishaps that require assistance.